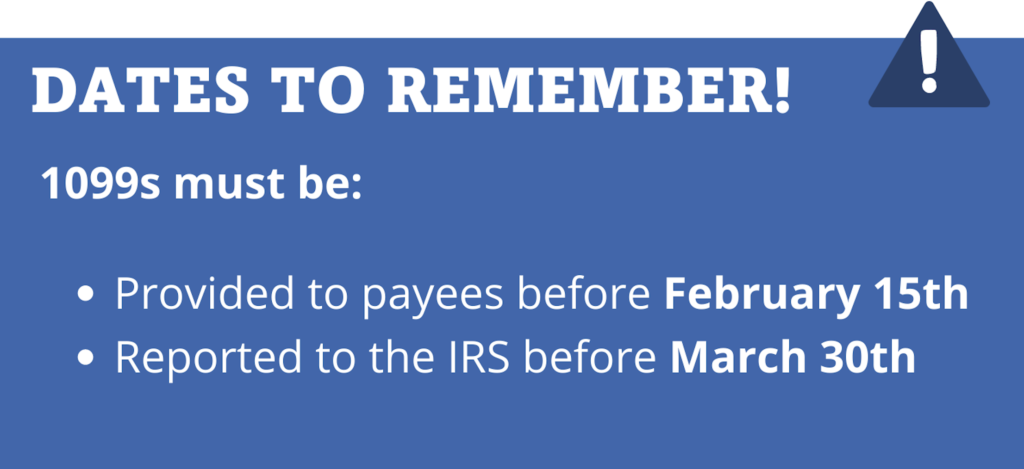

Title agencies often start the new year with a headache. Not because of their New Year’s Eve celebrations but because it is 1099-S season. As I am sure you already know, title agencies1 are required to furnish all eligible sellers (“payees”) with a copy of the 1099-S form and report the same information to the IRS. This often creates a scramble in the agency to collect the data and report to the necessary parties. It is also high stakes as late reporting, including fixing inaccurate reporting, can result in fines up to $270 per 1099-S.

We polled our internal experts and our customers and asked, “How can agencies improve 1099-S reporting?” Here are the results:

Assign a 1099-S “Quarterback”

Have someone in your agency that is responsible for 1099-S Reporting. Empower this person to create and manage the 1099-S process for your agency. In our agency, this person’s role, aside from 1099, is a closing specialist.

– A TitleFusion Customer in New Jersey

Have a 1099-S Plan

Create a plan that outlines how your agency will manage 1099-S reporting, don’t wait until the end of the year to figure it out. This should include how and when the information will be collected and how and when 1099-S information will be distributed to sellers and the IRS.

– A Landtech Customer in Florida

Collect All the Required Information Ahead of the Closing

Ensure that you have all the required information for the 1099-S form before closing the transaction. This sounds simple, but often, we see transactions where required information is missing. The most common pieces of information that are missed are tax ID, future mailing address, 1099-S exempt status, and “foreign person” status. Ensure this information is placed in the correct fields in your title management system, not manually entered on documents.

– Rita Simon, Vice President of Customer Operations, TitleFusion

Provide the 1099-S to the Seller at the Closing Table

If you furnish the 1099-S to the seller during the closing, you avoid the hassle and the cost of mailing it later. Also, this gives them ample time to review the information and report any inaccuracies back to you well before the reporting deadline.

– Jay Richardson, AccuTitle Chief Product Officer

Mail 1099-S to Sellers Each Quarter

Perhaps providing the 1099-S at the closing table is not a workable solution for your agency. Instead, mail them at the end of each quarter. This again provides ample time for sellers to report inaccuracies and avoids the rush at the beginning of the new year.

– Dorothy Costello, Vice President of Customer Operation, Closers’ Choice

Use A Vendor for 1099-S Mailing and IRS Reporting

Doing your own printing and mailing of 1099-S can be an arduous task (believe me, I’ve done it!). You and your staff will spend late nights printing and stuffing envelopes, worrying about sending the wrong 1099 to a seller. As for IRS reporting, you will have to set up and manage your own FIRE account. You can avoid all of this by selecting a vendor, like AccuTitle, that can do all of this for you.

– Michelle Roberts, Account Executive, TitleFusion

These tips should help empower your agency to have a smooth 1099-S process this year and hopefully avoid any headaches. If you are interested in hearing more about AccuTitle’s 1099-S Reporting services, please contact your sales representative or email us at sales@accutitle.com.

1) Per IRS rules: Generally, the person listed as the settlement agent on the Closing Disclosure must file Form 1099-S.

Additional Resources:

- 1099 in your AccuTitle Product

- 1099-S Form

- Instructions for 1099-S Form

- IRS 1099-S Resources