AccuTitle’s Data: What Trends Do We Expect for 2024

Navigating high interest rates, soaring prices, and dwindling inventory, the real estate market faces formidable challenges. Let’s look at how these factors, and others, are impacting market trends. Unlike other sources that report data from weeks or months in the past, AccuTitle can report data approximately six weeks before closing, allowing us to make some predictions about the near-term future.

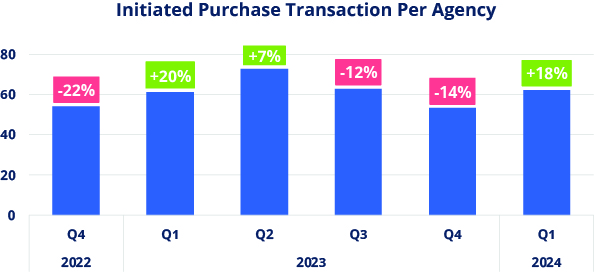

Purchase Market: A Resilient Rebound

Despite a lackluster Q4 2023, purchase transactions surged by an impressive 18% in Q1 2024, aligning with seasonal norms where holidays and chilly weather typically dampen activity. Notably, Northeastern purchase volume closely mirrored that of Q1 2023, hinting at a trajectory of growth expected to peak in May. Conversely, the Southeast saw purchase volume slightly trailing 2023 levels, with March or April traditionally heralding peak months. However, shifting inventory dynamics and pricing trends in the Southeast might disrupt this pattern, a topic we’ll explore further.

Interested in more information about typical seasonal patterns, check out our last AccuTitle Data Blog post.

Home Prices: Can Increased Inventory Lead to Price Relief?

We are all aware of the affordability crisis in real estate which is pricing many potential buyers out of the market. Many experts have noted that a decrease in interest rates is needed so homeowners with 2%-4% mortgages are no longer “locked in” and will be willing to sell their homes.Unfortunately, Federal Reserve chair Jerome Powell has signaled that, unless inflation indicators start falling, decreases in interest rates may be further off than our industry would like.

Despite this, inventory growth, particularly evident in the Southeast, historically correlates with downward pressure on prices. For instance, Florida experienced price relief in late Summer 2023 as inventory expanded. Q1 2024 prices defied expectations by rising but however, many experts believe lower prices are coming to many metro areas in Florida apart from Miami.

Conversely, in New Jersey prices saw an uptick as inventories dwindled. This pattern is representative of the Northeast in general. Overall, the prospect of increased inventory offers a glimmer of hope for price relief, yet the crucial ingredients of lower interest rates and increased construction activity have yet to materialize.

Refinances: A Surprising Surge?

Although the interest rate environment is not conducive to refinances, these loans increased by 14% compared to Q4 2023. Primarily comprising home equity loans or cash-out refinances, homeowners are tapping into the increased equity stemming from escalating home values. Homeowners may realize that current interest rates are not historically high; they are just not the rock-bottom lows seen in 2020-2021. Keeping an eye on this trend and others will be important as the year unfolds, offering valuable insights into emerging trends for 2024 and beyond.