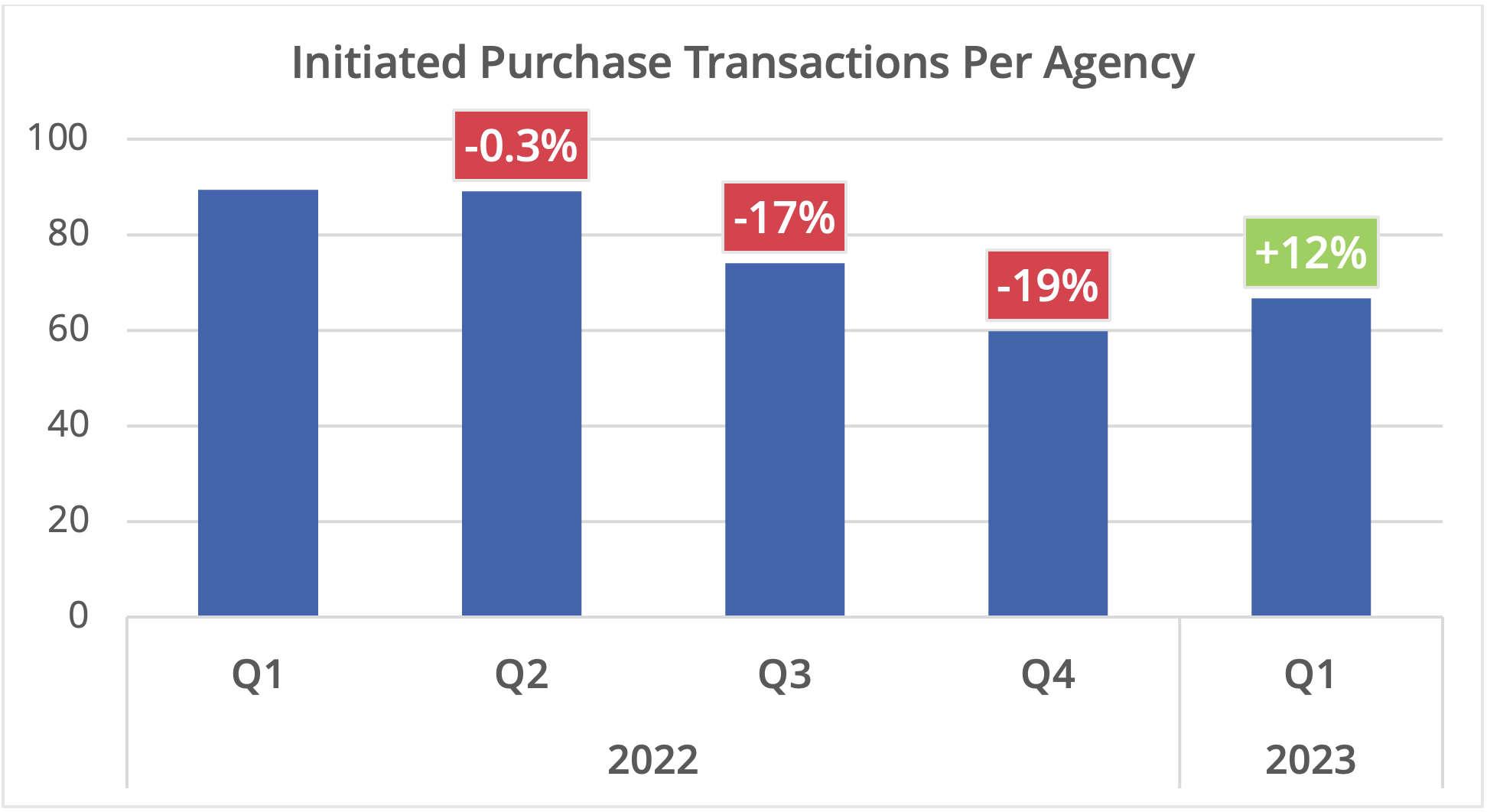

With Q2 2023 just around the corner, we are seeing a promising uptick in business! This is a welcome sign after the rough second half of 2022. We are projecting a 12% increase in initiated purchase transactions in Q1 2023, compared to Q4 2022. This comes on the heels of two challenging quarters where purchase transactions declined by 17% (Q3 2022) and 19% (Q4 2022). Since we can report data approximately 42 days before the closing, our metrics are a leading indicator of market conditions. We expect others to be reporting this good news in the coming month. 📈

Of course, seasonal patterns also play a role as well. Across the US, the end of the year is the “busy season” for many Americans, and therefore is slow for purchase transactions. In colder regions like the Northeast, purchase volume tends to increase throughout Q1 and peaks in May. This year, March looks strong, with a 5% increase over February, matching last year’s trend.

However, the Southeast is experiencing something different. While volume usually bounces back in January, we are seeing a continued climb in March. Is this due to improved market conditions? A good question for next time.

Home Prices: Are they coming down yet? 💰

While one would think with interest rates increasing, purchase prices would logically drop, instead, our data shows prices are continuing to climb in 2023. Despite a decline in 2022 after a peak in April, home prices have remained historically high. Our Median Home Price chart illustrates this well as we have extended the data back to the beginning of 2021. As we enter the busy season of 2023, prices remain close to their historic highs. 💸

Refinance Market: Interest Rates Make Waves 🌊

We are not seeing a rebound in the refinance market like we are with purchases. Interestingly, we saw a decline in refinance volume in the middle of 2021, long before major increases in interest rates. This might have been due to market saturation. Said another way, nearly everyone that should have refinanced already had done so. Of course, we saw this decline accelerate in 2022 as the Fed aggressively raised rates. However, with 2022 and 2023 loans creating “pent-up demand,” we could see a refinance rush when rates drop again. 📉

One last point on refinances, the commercial refinance market has remained stronger than the residential side because many business loans are refinanced every 5-10 years regardless of interest rates. Volume is about 20% of what we saw at the peak of the market in early 2021. 🏢

AccuTitle’s Data: A Reliable Source for Market Trends 📊

Why can you trust AccuTitle’s data? First, we are constantly measuring ourselves against multiple data sources, and our data aligns well with that provided by the Federal Reserve. Second, since approximately 10%-15% of all real estate transactions in the US flow through AccuTitle, we know we have an appropriate “sample size” to generalize market trends. 📊

AccuTitle’s data paints an exciting picture for Q2 2023, with plenty of potential for growth in the real estate market. Stay tuned for deeper dive’s into AccuTitle’s data.