The real estate market in the first half of 2023 was steady but not exciting. We experienced a less challenging market than Q3 or Q4 of 2022 but not the booming purchase and refinance market we experienced in the 2 years prior.

Let’s dig into the data to uncover some of the trends we saw in Q2 and, since we can report data approximately 42 days before closing, look at what might be in store for the market in Q3 and beyond.

Purchase Market: Steady… But A Bit Dull

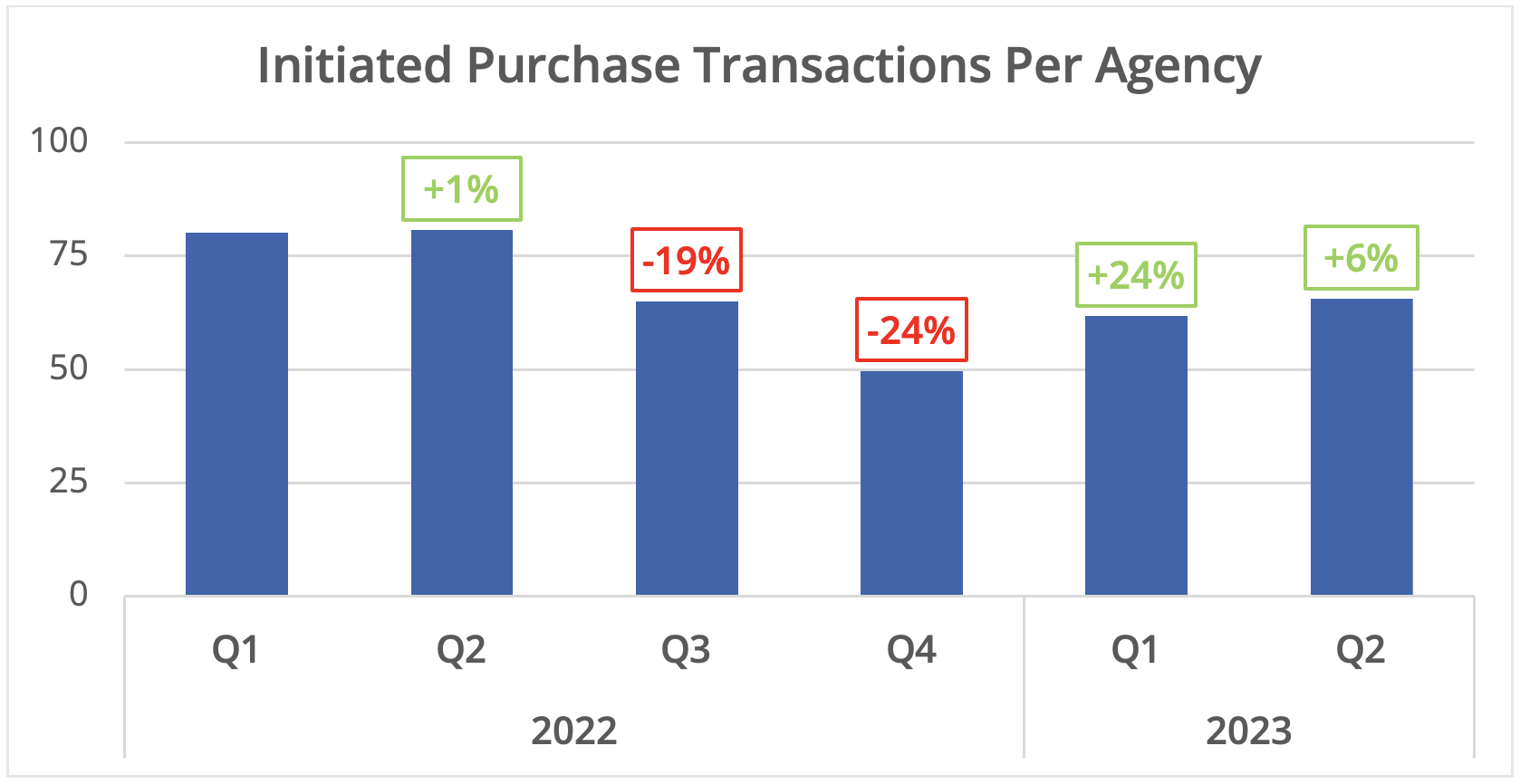

Thankfully, purchase transactions ticked upward in Q1 2023 after an abysmal Q4 2022. Purchases for Q2 improved modestly compared to Q1, increasing by 6% in our data. This can be attributed partly to typical seasonality in the market, which we will discuss below. Beyond seasonality, it represents a very slight improvement in market conditions. Many buyers are still “staying on the sidelines” due to home prices (discussed below) while potential sellers feel locked in by their current mortgage rates. However, others are realizing that the era of extremely low-interest rates has passed and now is as good a time as any to buy.

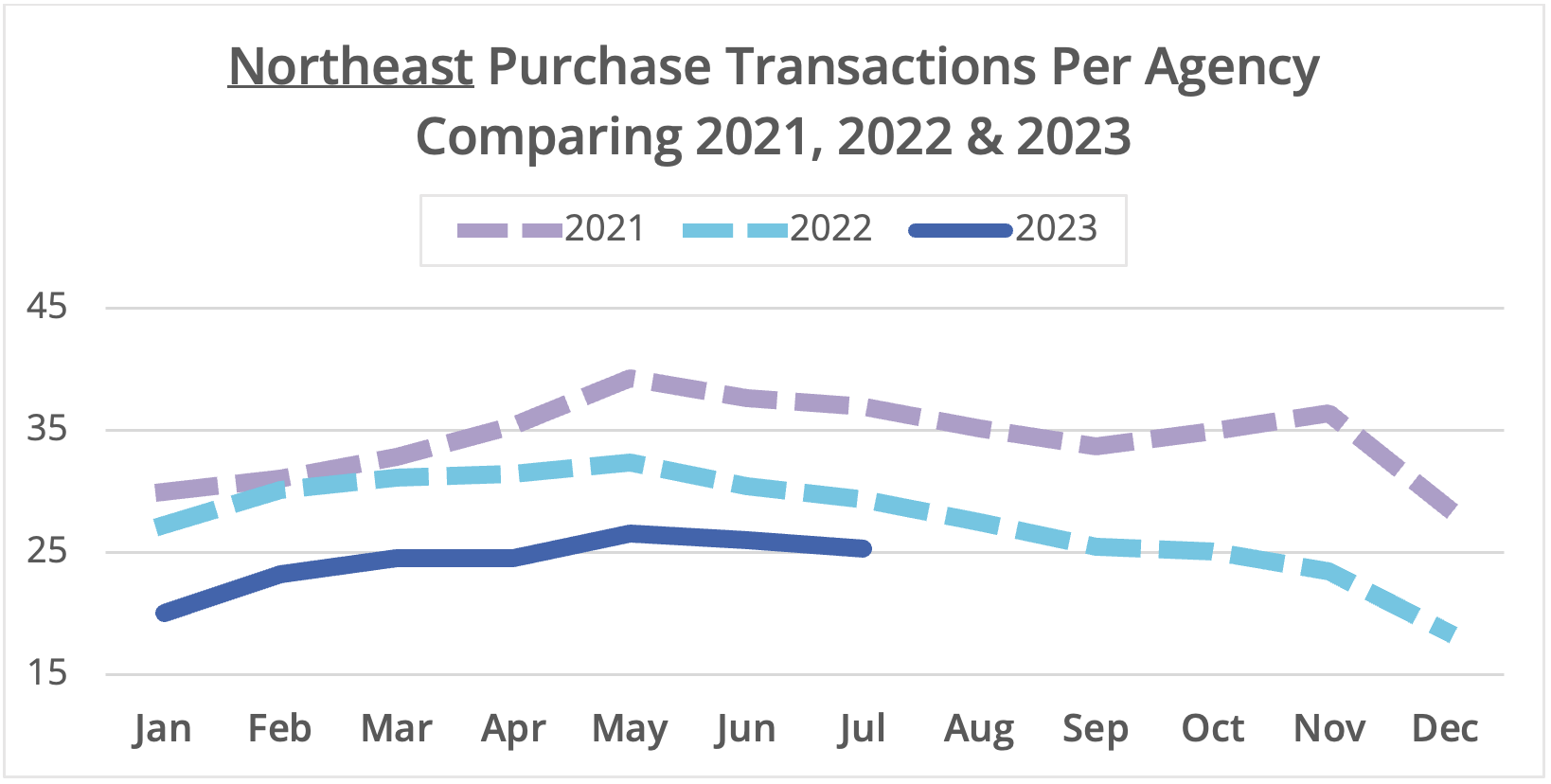

Digging into seasonal patterns, the Northeast typically peaks in May and slowly dips down before the real “slow season” arrives in September. This year’s pattern appears to be very similar, just at lower levels than 2022 and 2021.

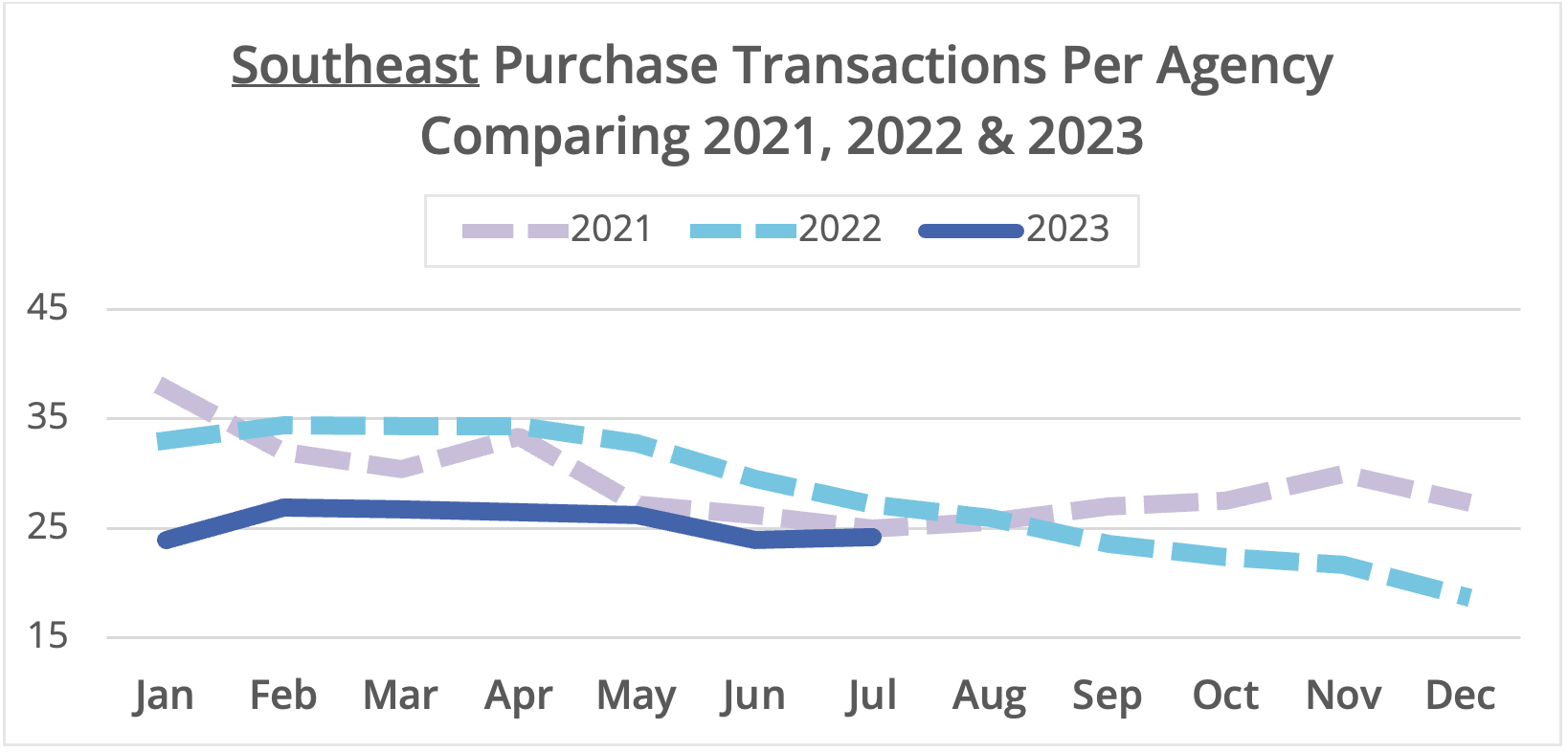

In the Southeast, the typical pattern is high volume in the “snowbird” months of January through April, which ticks down in the warmer months and trails off through the end of the year. This year, we saw a significant increase in February which remained steady until a dip in June. It is possible that we will see a different trend in this region this year, as the usual sharp summer decline has yet to materialize.

Have Home Prices Peaked?

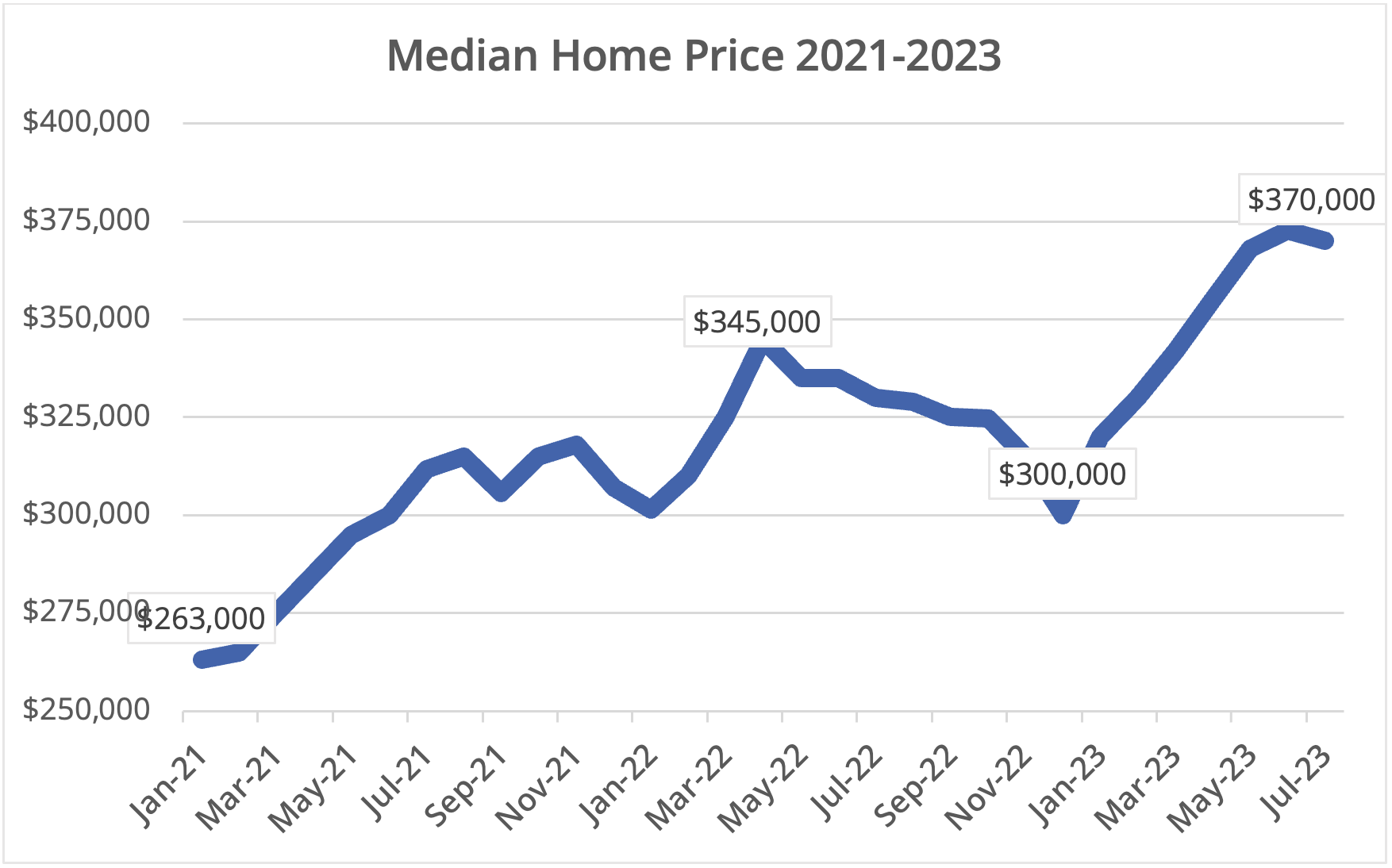

While home prices remain at historic highs, some recent data suggests that we may have hit the peak (for now). AccuTite’s data showed a 1% decline in prices nationwide for July. Also in July, prices in the Northeast declined for the first time in 7 months, while prices in the Southeast have remained relatively flat since February. Other sources of information match the trend we are seeing in our data in terms of measuring home prices and other indicators such as days on the market.

Where Is the Market Headed?

Predicting a significant transaction increase is difficult until we see a downward movement in interest rates and home prices. These two key metrics are tightly correlated as lower interest rates will allow current owners with 2%-3% mortgages to consider selling, which will, in turn, increase inventories and lead to downward price pressure.

One group that may hold the key to improved market conditions is the 42% of “free and clear” homeowners that do not have a mortgage, most of whom are over 55. In the coming years, they will increasingly down-size, move to warmer climates and retirement communities, increasing inventory independent of interest rates.